When you take a pill for high blood pressure or antibiotics, there’s a good chance it was made in China or India. These two countries together produce more than half the world’s generic drugs. But behind the low prices and steady supply lies a complex reality: China and India manufacturing aren’t equally safe, and the FDA’s monitoring of each is wildly different.

Why the FDA Cares More About India Than China

The U.S. Food and Drug Administration inspects thousands of drug factories every year. In 2023, India had over 100 facilities approved by the FDA. China had just 28. That’s not a typo. India has nearly four times as many FDA-approved plants. Why? Because Indian manufacturers have spent decades aligning with U.S. standards. They know what the FDA wants: clean rooms, documented processes, real-time quality checks, and zero tolerance for data manipulation. Chinese factories, by contrast, have struggled with consistency. While China makes about 80% of the world’s active pharmaceutical ingredients (APIs)-the actual medicine inside pills-many of those facilities have been flagged for poor recordkeeping, unapproved changes in formulas, or even falsified test results. The FDA issued import alerts to 37% of Chinese drugmakers in 2023. For India, that number was 18%. That’s not just a difference. It’s a warning.India’s Edge: Compliance Over Cost

India doesn’t win because it’s cheaper. It wins because it’s predictable. When a U.S. pharmaceutical company sends an FDA inspector to an Indian plant, they expect to see digital logs, automated sensors, and staff trained in 21 CFR Part 211-the FDA’s rulebook for drug manufacturing. Bain & Company found that Indian firms have implemented digital interventions across their plants to eliminate human error. That’s not marketing fluff. It’s survival. The Indian government has also pushed hard. The revised Schedule M regulations in 2023 forced manufacturers to upgrade equipment, improve waste management, and adopt real-time quality control. Over $3 billion in government incentives have flowed into pharmaceutical production since then. Companies like Alembic and Sun Pharma now export to over 150 countries. Their success isn’t luck. It’s discipline.China’s Strength: Scale, But at a Price

China’s advantage is simple: volume and cost. It can produce billions of tablets for pennies. That’s why so many U.S. companies still rely on it-for bulk APIs, for non-critical drugs, for products that don’t require strict FDA oversight. But that scale comes with risk. Smaller Chinese suppliers often operate without proper quality controls. One FDA inspection report from 2022 found a facility in Shandong that had reused water filters for months, contaminated batches, and no system to trace where each ingredient came from. The Chinese government has tried to clean things up. They’ve adopted ISO and CE standards. But enforcement is uneven. A plant in Shanghai might be spotless. One just 50 miles away might be cutting corners. That inconsistency makes it hard for the FDA to trust the entire system. And with rising labor costs, China’s price advantage is shrinking. Companies that once chose China for savings are now asking: Is it worth the risk?

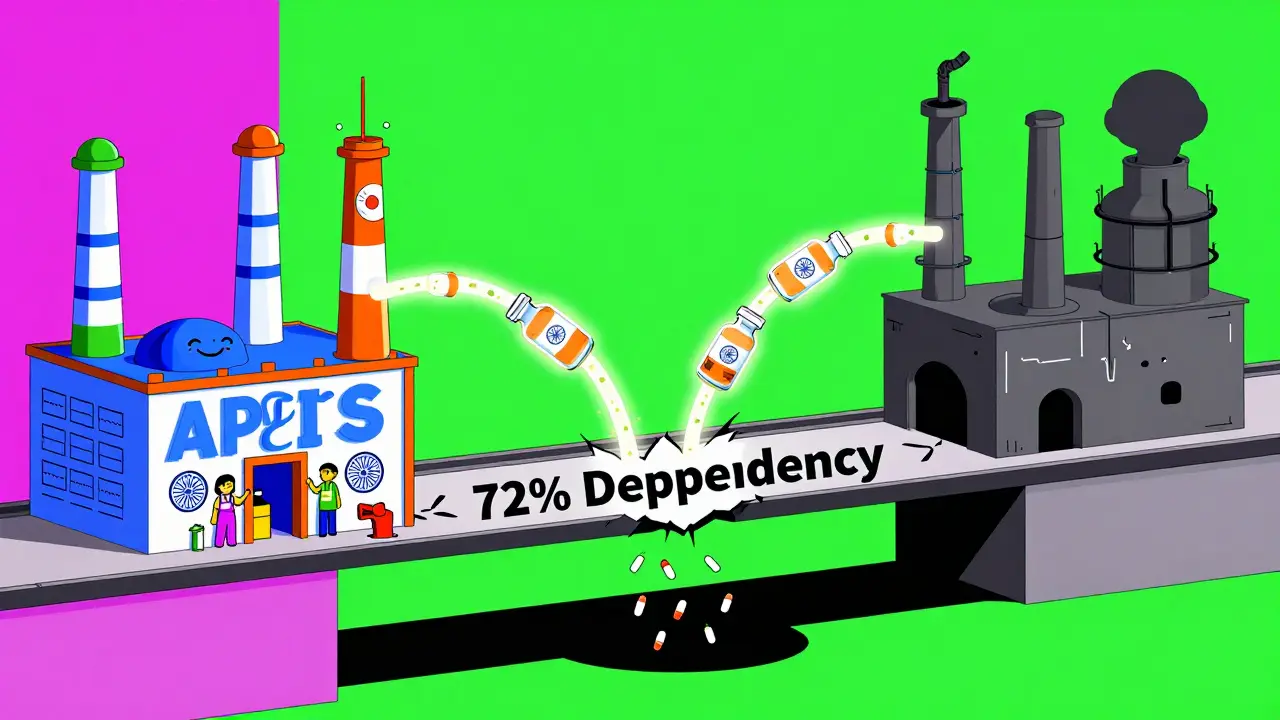

The Hidden Weakness: India’s Dependence on China

Here’s the twist no one talks about: India still imports 72% of its bulk drug ingredients from China. That means even the most FDA-compliant Indian factory is building pills with raw materials from a country the FDA doesn’t fully trust. It’s like using a certified chef to cook with spoiled meat. A senior sourcing executive at a major U.S. drugmaker told Bain & Company: “The 72% import dependency on China creates a single point of failure in our supply chain.” That’s not theoretical. During the pandemic, when China shut down factories, India ran out of APIs. Millions of prescriptions went unfilled. That’s why India’s “Make in India” program is now pushing hard to produce its own APIs. But building that capacity takes time, money, and expertise-things China has had decades to develop.What the FDA Actually Does

The FDA doesn’t just show up with a clipboard. They send teams of inspectors who live in the plant for days. They check temperature logs. They review raw material certificates. They pull samples and test them in their own labs. They interview workers. They look for signs of pressure to hide mistakes. Indian facilities get fewer Form 483 observations-the official notices of violations-than Chinese ones. In fact, during inspections between 2020 and 2023, Indian plants had 30% fewer issues. That’s because Indian managers know: one violation can mean a product gets blocked at the border. That’s why they train staff like pilots: every step, every check, every signature matters. In China, inspections are more unpredictable. Some plants pass easily. Others get shut down for months. The FDA can’t always tell which is which until it’s too late. That’s why they’ve increased the frequency of inspections in China-and why they’ve started requiring more pre-approval audits for new Chinese suppliers.Why the ‘China+1’ Strategy Is Changing Everything

The phrase “China+1” isn’t jargon. It’s a survival tactic. After years of relying on China alone, companies realized one country can’t be your entire supply chain. So they started adding India as a backup. Not because India is perfect. But because it’s reliable. A 2023 Medstown analysis found that global pharma firms now trust India more than China. Why? “Good pricing, good labor force, and a solid compliance history.” That’s it. No buzzwords. Just results. Companies are now splitting production. They make high-volume, low-margin generics in China. They make critical drugs-like heart medications, insulin, or antibiotics-in India. That way, if one side fails, the other keeps the lights on.

What’s Next? The Real Battle Is in Biologics

The next frontier isn’t pills. It’s biologics-complex drugs made from living cells. Think cancer treatments, vaccines, gene therapies. China is investing heavily here. Its biopharmaceutical market is growing at 19.3% a year. India’s is growing faster-at 22%-but it’s still small. Right now, China leads in biologics manufacturing capacity. If India wants to stay ahead, it can’t just keep making cheap generics. It needs to move up the value chain. That means building clean rooms for cell cultures, hiring scientists who understand protein folding, and getting FDA approval for complex products. It’s expensive. It’s hard. But it’s the only way to avoid being stuck as China’s supplier.What This Means for You

If you’re a patient, you’re probably fine. Most drugs on the shelf are safe. The FDA’s system, while imperfect, catches most problems before they reach you. But if you’re a pharmacy owner, a hospital buyer, or a health policy maker, this matters. You need to know where your drugs come from. Not just the brand name. Not just the price. The factory. The country. The compliance history. The days of choosing a supplier based on cost alone are over. The real question now is: Who can you trust when your life depends on it?Are drugs made in India safer than those made in China?

Yes, generally. Indian manufacturing facilities have significantly higher FDA approval rates and fewer compliance violations. In 2023, only 18% of Indian drugmakers faced FDA import alerts, compared to 37% of Chinese ones. Indian firms are also more likely to use digital quality systems that reduce human error. However, India still depends on China for 72% of its raw ingredients, which creates a hidden vulnerability.

Why does the FDA inspect Indian factories more often than Chinese ones?

The FDA doesn’t inspect Indian factories more often-it inspects them more successfully. India has over 100 FDA-approved plants, while China has only 28. That’s because Indian manufacturers have spent years aligning with U.S. standards. The FDA spends less time fixing problems in India and more time approving new products. In China, inspectors often find serious violations that require follow-up visits or shutdowns, which slows down the approval process.

Can I tell if my medicine was made in China or India?

Not easily. U.S. law doesn’t require manufacturers to list the country of origin on drug labels. The only way to know is to contact the brand or check the FDA’s Drug Registration database, which lists the facility location. For most consumers, this isn’t practical. But if you’re concerned, choose brands that publicly disclose their supply chain-some large companies now do this for transparency.

Is India’s pharmaceutical industry growing faster than China’s?

India’s export market is growing faster. While China still produces more total drugs by volume, India’s pharmaceutical exports are projected to grow 10- to 15-fold by 2047, reaching nearly $350 billion. That’s thanks to its strong compliance record and the global shift toward supply chain resilience. China’s share of the global outsourced market is expected to drop from 25% to 15% by 2047 as companies move production to India and other countries.

Should I avoid drugs made in China?

No. Many safe, effective drugs are made in China, especially non-critical generics and APIs. The FDA still approves thousands of Chinese facilities each year. The risk isn’t in the country-it’s in the specific manufacturer. A well-run Chinese plant can be just as safe as an Indian one. The key is choosing brands that are transparent about their suppliers and have a history of FDA compliance.

Hadi Santoso

December 17, 2025 AT 03:34man i had no idea so many of my meds came from india or china. i just take the little pills and hope for the best. kinda scary to think about how little we know about what’s actually in them. my grandma always said ‘if you can’t read the label, don’t swallow it’ - guess she was righter than she knew.

Billy Poling

December 19, 2025 AT 02:17It is of paramount importance to recognize that the structural disparities in regulatory compliance between the Indian and Chinese pharmaceutical manufacturing sectors reflect not merely operational inefficiencies, but systemic cultural divergences in governance, accountability, and institutional prioritization. The Indian regulatory alignment with 21 CFR Part 211 is not an accident of policy-it is the result of decades of deliberate institutional adaptation to Western biomedical norms, whereas China’s approach remains fragmented, state-driven, and economically incentivized, often at the expense of transparency. This is not a matter of national superiority, but of institutional maturity.

Randolph Rickman

December 19, 2025 AT 12:46Really glad this post broke it down so clearly. I work in hospital procurement and we’ve been shifting more orders to Indian suppliers for critical meds-especially antibiotics and insulin-because the audit reports just don’t lie. Yeah, China’s cheaper, but when your patient’s life is on the line, ‘cheap’ doesn’t cut it anymore. Also, shoutout to India for pushing their own API production. It’s slow, but they’re trying. We need more of that kind of long-term thinking.

Tiffany Machelski

December 20, 2025 AT 16:56i never thought about how india gets its raw stuff from china… that’s wild. so even if the factory is clean, the stuff inside might not be? kinda like buying a new car but putting in used engine parts. 🤦♀️

Souhardya Paul

December 21, 2025 AT 12:55This is such a nuanced take. I’ve always assumed ‘made in China’ meant risky, but the part about China making most APIs and India relying on them changed my view. It’s not about which country is better-it’s about how interconnected the system is. We need global standards, not just national ones. Also, biologics is the next big thing. If India can crack that, they’ll be unstoppable. Hope they get the funding.

Josias Ariel Mahlangu

December 21, 2025 AT 17:14Western nations cling to India as the ‘ethical’ alternative while ignoring the fact that India’s entire supply chain is built on Chinese exploitation. This is not purity-it is dependency dressed up as virtue. The FDA’s preference is not a moral victory; it is the continuation of colonial logic: we trust the servant more than the master, even when the servant is still feeding from the master’s table.

anthony epps

December 22, 2025 AT 23:08so wait, if india makes the pills but gets the medicine from china… then why do we say the pills are ‘made in india’? that feels misleading. like putting ‘assembled in usa’ on a phone with parts from china.

Andrew Sychev

December 23, 2025 AT 03:04THEY’RE ALL LYING. EVERY SINGLE ONE OF THEM. THE FDA? INEFFECTIVE. INDIA? A GLORIFIED SUBCONTRACTOR. CHINA? A CORRUPT EMPIRE. AND WE’RE STILL SWALLOWING PILLS LIKE THEY’RE CANDY. ONE DAY, SOMEONE’S KID WILL DIE FROM A CONTAMINATED ANTIBIOTIC, AND THEN WHAT? WE’LL POST A MEME ABOUT ‘SUPPLY CHAIN RESILIENCE’? THIS IS A TIME BOMB AND NO ONE WANTS TO TALK ABOUT IT.