When you're on Medicare and need prescription drugs, understanding how generic drugs work in your Part D plan can save you hundreds - even thousands - of dollars each year. Most people assume all prescriptions cost the same under Medicare, but that’s not true. The difference between a $0 generic and a $100 brand-name drug isn’t just about the pill inside the bottle. It’s about how your plan’s formulary is built, what tier it’s on, and how the new out-of-pocket cap changes everything.

What Is a Medicare Part D Formulary?

A formulary is simply a list of drugs your Medicare Part D plan covers. Think of it like a menu: not every medication is available, and the ones that are come with different prices. Every plan has its own formulary, approved by the Centers for Medicare & Medicaid Services (CMS), and they must follow strict rules. For example, they have to cover at least two different generic versions of every type of drug - like blood pressure pills or antidepressants - so you’re not stuck with just one option.Generics make up 92% of all prescriptions filled under Part D, but they only account for 18% of total drug spending. That’s because they cost way less than brand-name drugs. In 2025, the average copay for a preferred generic on Tier 1 is $0 to $15 for a 30-day supply. For a brand-name drug on Tier 4 or 5? It could be $40 to $100 or more.

How Tiered Formularies Work for Generics

Part D plans use five tiers to organize drugs by cost. Generics live mostly in the first two tiers:- Tier 1 (Preferred Generics): These are the cheapest. You’ll often pay $0-$15 per prescription. Most plans put common generics like lisinopril (for blood pressure) or metformin (for diabetes) here.

- Tier 2 (Non-Preferred Generics): Slightly more expensive. You might pay a flat copay of $20-$40 or 25-35% coinsurance. These are still generics, but maybe newer or less commonly prescribed.

- Tiers 3-5: These are mostly brand-name and specialty drugs. Generics rarely appear here - unless it’s a high-cost specialty generic, like some cancer drugs.

The system is designed to nudge you toward the lowest-cost option. If your doctor prescribes a generic, your plan will usually prefer the one on Tier 1. If you ask for a different generic in the same class - say, you want a different version of losartan - you might pay more or even get denied unless your doctor files an exception.

How Much Do You Actually Pay?

Your out-of-pocket cost depends on what phase of coverage you’re in. In 2025, here’s how it breaks down:- Deductible phase: You pay 100% until you hit $615. Not all plans have a deductible - 52% of stand-alone Part D plans in 2025 have a $0 deductible for generics.

- Initial coverage phase: After you meet the deductible, you pay 25% of the drug’s cost. For a Tier 1 generic priced at $10, that’s $2.50. For a Tier 2 generic at $30, that’s $7.50.

- Catastrophic coverage phase: Once you’ve spent $2,000 out of pocket in 2025 (rising to $2,100 in 2026), you pay nothing. That’s the biggest change since Part D started.

Here’s what’s tricky: for brand-name drugs, 70% of the drug’s price counts toward your $2,000 cap - including manufacturer discounts. For generics, only what you actually pay counts. So if you’re on multiple generics, you’ll hit the cap faster than if you’re on brand-name drugs.

Why Some Generics Are Covered and Others Aren’t

You might be confused if your plan covers one generic for a drug but not another - even if they’re chemically identical. For example, your plan might cover generic amlodipine from Pfizer but not the one from Teva. That’s allowed. Plans can pick which generics to include, as long as they cover at least two in each drug class.This causes real problems. A 2024 Medicare Rights Center survey found that 62% of beneficiaries face formulary differences when comparing plans. One Reddit user, MedicareVeteran82, shared that his plan covered a different generic for his blood pressure medicine - so when his pharmacist tried to switch him, he got stuck paying full price. That’s because the substitution wasn’t on the formulary.

There are exceptions, though. For six protected drug classes - including antidepressants, antiretrovirals, and anticonvulsants - plans must cover every available generic. No exceptions. That’s to make sure people with serious conditions aren’t left without options.

How the Inflation Reduction Act Changed Everything

Before 2025, there was a gap in coverage called the “donut hole.” After you spent a certain amount, you paid 100% until you hit a high threshold. That’s gone now.The Inflation Reduction Act, which took effect January 1, 2025, created a hard $2,000 annual cap on what you pay out of pocket for all drugs - including generics. Once you hit that, your plan pays 100% for the rest of the year. That means:

- If you take three generics costing $30/month, you’ll hit the cap in about 5-6 months.

- After that, your prescriptions cost $0 - no more coinsurance, no more surprises.

That’s a huge win. CMS estimates beneficiaries will save an average of $450 per year on generics alone because of this change.

What You Need to Do Every Year

Plans change their formularies every year. A generic that was on Tier 1 in 2024 might move to Tier 2 in 2025 - or get dropped entirely. That’s why you must review your Annual Notice of Change (ANOC) every fall.Here’s what to do:

- Log into the Medicare Plan Finder and enter your exact medications - including generic names.

- Compare at least three plans. Look at the tier, copay, and deductible for each drug.

- Use the “Formulary Finder” tool to check if your generics are covered.

- If you’re on multiple generics, prioritize plans with a $0 deductible and low-tier copays.

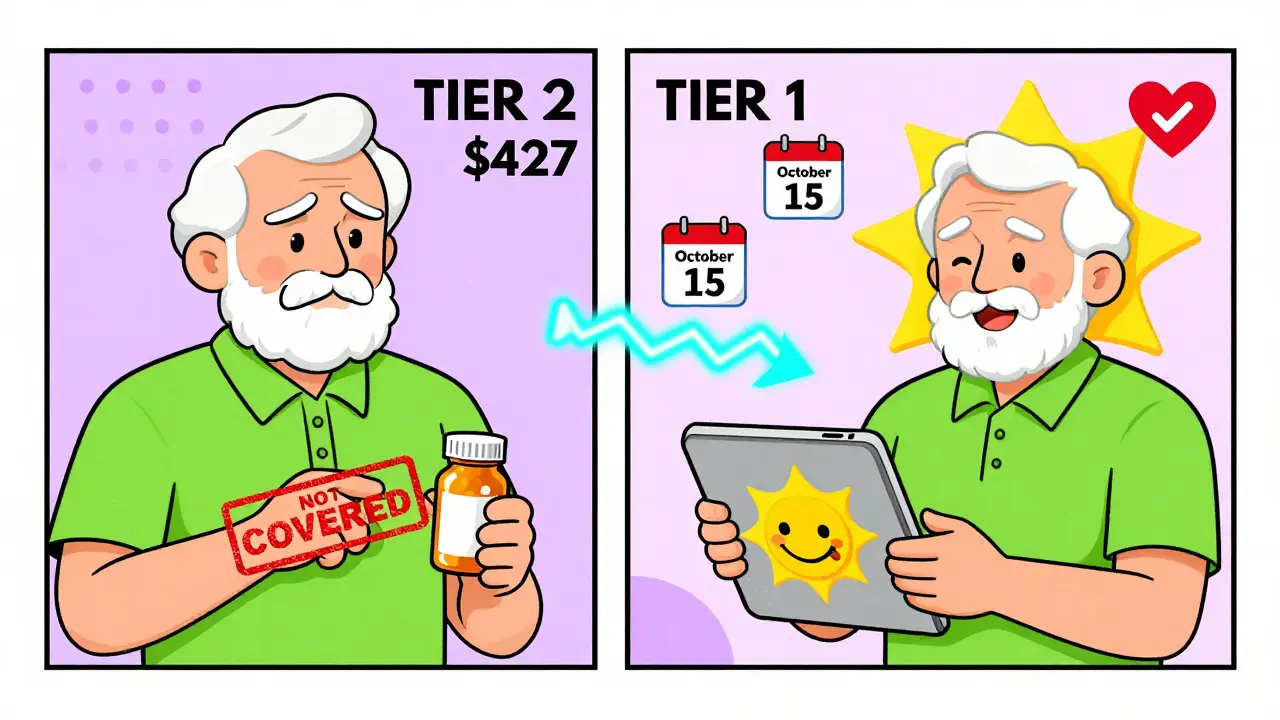

KFF research shows that people who use the Plan Finder save an average of $427 a year. That’s more than the cost of a monthly phone bill.

What If Your Generic Isn’t Covered?

If your plan doesn’t cover a generic you need, you can request a coverage determination. This is a formal request asking your plan to cover the drug anyway. In 2023, 83% of these requests were approved - especially if your doctor explains why the covered generic won’t work for you.You can also ask your pharmacist for a therapeutic interchange. That means switching to a covered generic in the same class. But make sure your doctor approves it. Sometimes, one generic works better for you than another, even if they’re chemically the same.

What’s Coming Next

Starting in 2026, Medicare plans must include a “generic price comparison tool” in their member portals. This will let you see which version of a generic costs the least - even if it’s not the one your doctor originally prescribed.In 2029, the first negotiated generic prices will kick in. Insulin glargine (the generic version of Lantus) is already on the list. That means even more savings ahead.

Analysts predict that by 2027, 95% of Medicare beneficiaries will have access to $0 copays for at least half of the most common generics. That’s because competition is driving prices down - and the government is pushing plans to make coverage simpler.

Real Stories, Real Savings

One beneficiary, SmartSenior2024, posted on Reddit: “My three generic heart medications cost me $0 under my Plan D’s Tier 1 coverage. I save over $300 monthly compared to what I paid before Medicare.”That’s not unusual. For people on fixed incomes, generic coverage isn’t just a perk - it’s a lifeline. And with the $2,000 cap, even those taking multiple drugs no longer have to worry about hitting a financial wall.

Final Tips

- Always use generic names when searching - “metformin,” not “Glucophage.”

- If your copay jumps unexpectedly, check your plan’s formulary update.

- Ask your pharmacist: “Is there a cheaper generic on my plan’s Tier 1?”

- Don’t assume your plan stays the same. Review it every fall.

- Use the Medicare Plan Finder - it’s free and easy.

Generic drugs are the backbone of Medicare Part D. They’re safe, effective, and dramatically cheaper. But you have to know how to use the system to get the best deal. Don’t just stick with your current plan because it’s familiar. A smarter choice could save you hundreds - or even thousands - each year.

Are all generic drugs covered under Medicare Part D?

Not every generic is covered - but most are. Medicare Part D plans must cover at least two generics in each drug class and at least 85% of drugs in each therapeutic category. However, plans can choose which specific generics to include. For example, one plan might cover generic amlodipine from one manufacturer but not another. Always check your plan’s formulary before enrolling.

Why is my generic drug not covered even though it’s the same as the one my friend takes?

Plans can cover different versions of the same generic drug. Even though two generics are chemically identical, your plan may only list one of them on its formulary. If your pharmacist tries to substitute a different generic, you might pay full price if it’s not on your plan’s list. Ask your doctor to prescribe the specific generic your plan covers, or request a coverage exception.

How does the $2,000 out-of-pocket cap work for generics?

Once you’ve spent $2,000 out of pocket on covered drugs in 2025 (rising to $2,100 in 2026), you enter catastrophic coverage and pay nothing for the rest of the year. For generics, only the amount you actually pay counts toward this cap - not the drug’s full price. That means if you take multiple low-cost generics, you’ll hit the cap faster than if you were taking expensive brand-name drugs.

Can I switch plans if my generic gets moved to a higher tier?

Yes. Each fall, during the Annual Enrollment Period (October 15 to December 7), you can switch to a different Part D plan that covers your generics at a lower cost. You don’t have to wait until your current plan changes. Use the Medicare Plan Finder to compare plans and see how your medications stack up before making a change.

Do all Medicare Part D plans have the same generic copays?

No. Copays vary by plan and tier. Some plans offer $0 copays for preferred generics on Tier 1, while others charge $15 or more. Tier 2 generics may have higher copays or coinsurance. Plans also differ on deductibles - 52% of 2025 plans have a $0 deductible for generics. Always compare the total cost, not just the monthly premium.

What should I do if my doctor prescribes a brand-name drug but I want the generic?

Ask your doctor if a generic version is appropriate. Most brand-name drugs have generic equivalents that work just as well. If your doctor agrees, they can write the prescription for the generic. If your plan doesn’t cover the generic you want, you can request a coverage determination or ask for a therapeutic interchange - a switch to a covered generic in the same class.

saurabh singh

January 4, 2026 AT 02:21Man, I just switched my Part D plan last year after reading this - went from paying $45/month for metformin to $0. My mom in Delhi is still paying out of pocket for hers because she doesn’t know about the cap. Gotta spread the word, fam.

Vicki Yuan

January 5, 2026 AT 05:38It’s remarkable how many beneficiaries still don’t realize generics only count toward the $2,000 cap based on what they actually pay - not the wholesale price. That’s why people on multiple low-cost generics hit catastrophic coverage faster than those on brand-name drugs. This nuance is critical.

Jacob Milano

January 5, 2026 AT 20:18I used to think the donut hole was just a myth - until I was stuck paying $80 for my blood pressure med back in 2022. Now? My three generics cost me squat after May. I’m not just saving money - I’m sleeping better at night. This policy change feels like a hug from the government.

Enrique González

January 6, 2026 AT 02:58Check your formulary every fall. Seriously. My plan moved lisinopril to Tier 2 last year. I didn’t notice until my copay jumped. Took me three weeks to fix it. Don’t be like me.

Aaron Mercado

January 7, 2026 AT 01:50WHAT?!?!? You mean people are STILL getting stuck with $30 copays for generics because they didn’t check the formulary?!?!? This isn’t rocket science!! You have a FREE TOOL ON THE GOVERNMENT WEBSITE!! And you just… accept it?!?!? I’m not mad… I’m just disappointed. And honestly? A little scared for our future.

Dee Humprey

January 8, 2026 AT 21:45My grandma uses the Plan Finder every year. She doesn’t have a smartphone - so I print out the results and we go over them with her pharmacist. She saved $520 last year. Small steps, big wins 🌸

John Ross

January 9, 2026 AT 15:55Formulary design is a classic example of managed care optimization. The tiered structure leverages pharmacoeconomic principles to incentivize utilization of high-value therapeutics. The 92% prescription volume vs. 18% spend metric is textbook cost-shifting efficiency. You’re not just saving money - you’re participating in a value-based purchasing model.

jigisha Patel

January 10, 2026 AT 17:41Let’s be clear: the $2,000 cap is a superficial band-aid. The real issue is the lack of price transparency and the pharmaceutical industry’s monopolistic control over generic manufacturing. Until we regulate the wholesale acquisition cost (WAC) of generics, this is just political theater. Also, your ‘Tier 1’ generic may be identical to the one you’re denied - but your plan’s contract with the manufacturer dictates everything. This isn’t healthcare. It’s corporate arbitrage.

Michael Rudge

January 11, 2026 AT 11:42Wow. So people are actually surprised that insurance companies pick which generic they want you to use? Did you think this was a free market? You’re lucky they let you use ANYTHING. At least you’re not in Canada - they make you wait six months for insulin. You’re welcome.

Doreen Pachificus

January 12, 2026 AT 14:11My neighbor’s plan dropped her generic for gabapentin last year. She cried. Then she called her doctor, got a coverage exception, and now she’s fine. It’s wild how much power you have if you just ask.

Jack Wernet

January 14, 2026 AT 06:14The Inflation Reduction Act’s impact on Part D formularies represents a significant structural shift in the American healthcare landscape. The removal of the coverage gap and the introduction of the out-of-pocket cap have fundamentally altered beneficiary behavior and pharmaceutical pricing dynamics. This is not merely a policy change - it is a redefinition of access.

Charlotte N

January 16, 2026 AT 00:58Just wanted to say… I didn’t know generics didn’t count the full price toward the cap… that’s wild… I’m gonna check my plan again this fall… maybe I’m overpaying…