When your medication costs more than your rent, you don’t need a textbook on insurance formularies-you need help right now. That’s where prescription assistance programs from drug manufacturers come in. These aren’t charity campaigns or vague promises. They’re real, functional programs run by companies like Pfizer, Merck, and Eli Lilly that put actual money into patients’ pockets-or directly pay pharmacies-to make life-saving drugs affordable.

Two Types of Help, Two Very Different Rules

There are two main kinds of manufacturer assistance: copay assistance programs and Patient Assistance Programs (PAPs). They sound similar, but they’re built for completely different people.Copay assistance is for people who have insurance but still can’t afford their out-of-pocket costs. Maybe your plan has a $2,000 deductible, and your specialty asthma inhaler costs $500 per prescription. A copay card from the manufacturer might cut that to $15 per fill. These cards work like coupons-you present them at the pharmacy, and the drug company pays the rest. In 2023, 85% of specialty drugs offered some kind of copay support, according to PhRMA. The average annual cap on these programs ranges from $1,000 to $25,000, depending on the drug. Some even limit you to $200 per month. If you take your medication every month, that adds up fast.

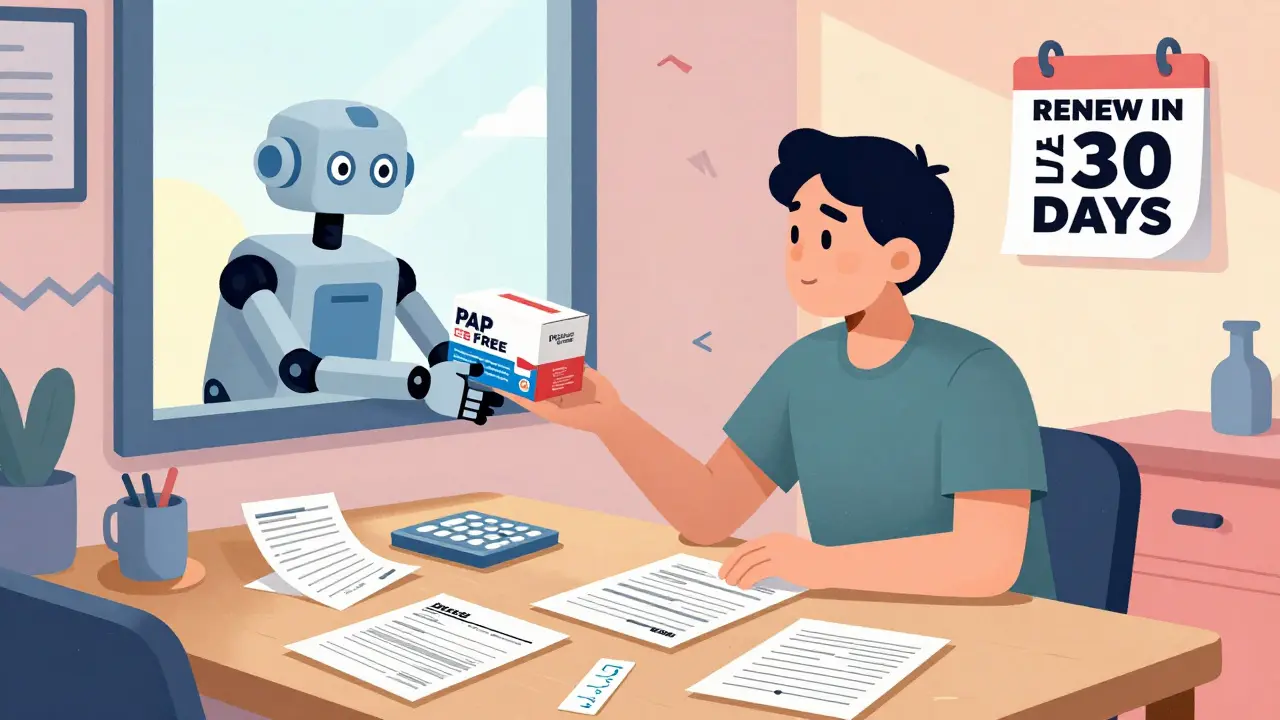

Patient Assistance Programs (PAPs) are for people without insurance-or with insurance that doesn’t cover their meds. These programs give you the drug for free, or nearly free. To qualify, you usually need to prove your income is below 400% of the Federal Poverty Level. For a family of four in 2023, that meant earning less than $60,000 a year. You’ll need tax returns, pay stubs, and sometimes a doctor’s note confirming you need the drug. Unlike copay cards, PAPs don’t require you to go to the pharmacy every month. Many programs ship your medication directly to your home.

What You Can’t Use These Programs For

Here’s the catch: these programs don’t work the same way for everyone. If you’re on Medicare or Medicaid, your options shrink dramatically.Medicare Part D beneficiaries can’t use manufacturer copay assistance to count toward their out-of-pocket spending that gets them out of the coverage gap. The government calls this the “true out-of-pocket cost” (TrOOP). Even if a copay card saves you $400 on a drug, that $400 doesn’t move you closer to catastrophic coverage. You’re still stuck paying full price until you hit the cap yourself. That’s a hidden trap-many patients don’t realize their savings aren’t helping them escape the donut hole.

And here’s the bigger problem: 78% of state Medicaid programs ban the use of manufacturer copay assistance. Why? Because they believe it drives up drug prices by keeping patients on expensive brand-name drugs instead of cheaper generics. So even if you qualify for Medicaid, you’re likely locked out of the very programs designed to help you.

As for PAPs, most exclude people with any government insurance. The Asthma and Allergy Foundation of America notes clearly: “If you have Medicaid or Medicare, there is no assistance program” for certain drugs. That leaves millions of low-income seniors and disabled Americans in a gap no program fills.

How Much Does It Actually Save?

The numbers are real. In 2022, pharmaceutical companies gave away $24.5 billion in direct patient assistance. That helped 12.7 million people get their meds. For some, it’s the difference between taking their insulin and skipping doses.Take Dulera, an asthma inhaler. Through Teva’s Cares Patient Assistance Program, eligible patients pay as little as $15 per prescription-down from over $300. That’s a 95% discount. For patients on multiple specialty drugs, the savings can be life-changing. One patient with rheumatoid arthritis told a nonprofit group she went from spending $1,200 a month on her biologic to $0. She didn’t have to choose between her medication and groceries anymore.

But not all programs are this generous. Some only cover a portion of the cost. Others require you to pay a small monthly fee-like $10 per prescription-as noted by the Asthma and Allergy Foundation. And if you’re on a high-deductible plan, your insurer might have a “copay accumulator” policy. That means your manufacturer discount doesn’t count toward your deductible. You’re still paying full price until you hit the cap, even if your copay card says you’re “saving” money.

The Application Process: It’s Not Easy

You’d think getting help would be simple. It’s not.Applying for a PAP can take 45 to 60 minutes per program. You need proof of income, proof of residency, your doctor’s signature, and sometimes a copy of your prescription. Some programs require re-application every year. Others auto-renew-but only if you submit updates on time. Miss a deadline, and your meds stop coming. No warning. No notice.

And awareness? Shockingly low. A 2022 survey by the Patient Advocate Foundation found only 37% of eligible patients even knew these programs existed. Most people assume their doctor or pharmacist will tell them. They won’t. Pharmacies are busy. Doctors are overwhelmed. You have to ask.

That’s why the Medicine Assistance Tool (MAT), run by PhRMA, is one of the most useful resources out there. It’s free, confidential, and lets you search over 900 programs by drug name, income level, or insurance status. You don’t have to call 10 companies. Just type in your medication, answer a few questions, and it shows you exactly what you qualify for.

Why This System Exists-and Why It’s Broken

These programs didn’t appear because drug companies are suddenly generous. They were created because drug prices exploded. In the late 1990s, brand-name medications started costing hundreds, then thousands, then tens of thousands per year. Patients couldn’t pay. Insurers couldn’t cover it all. So manufacturers stepped in-not out of kindness, but out of necessity. If people couldn’t afford their drugs, sales would drop.But here’s the irony: these programs make the system worse. A 2022 study in JAMA Internal Medicine found copay assistance pushes patients toward more expensive brand-name drugs-even when cheaper generics exist. That drives up total spending by an estimated $1.4 billion a year. It’s like giving someone a discount on a luxury car while telling them they can’t buy a reliable used one.

And the lack of oversight is staggering. The NIH noted in 2021 that no single entity tracks how many people use PAPs, how much they save, or whether they’re actually getting better health outcomes. There’s no accountability. No public reporting. Just billions in aid, with no way to measure if it’s working.

What’s Changing in 2026?

Regulators are waking up. As of January 2026, 22 states have passed laws restricting or requiring transparency around copay assistance. California’s SB 1424, enacted in 2024, forces drugmakers to publicly report how much they spend on these programs. The federal government is also pushing for more disclosure. In October 2023, HHS proposed new rules that would require manufacturers to show exactly how their assistance affects drug pricing.Meanwhile, pharmacy systems are getting smarter. MAT now connects directly with major pharmacy networks. When you show your copay card, the system auto-applies the discount. No manual processing. No delays. That’s a big step forward.

But the big question remains: are these programs fixing the problem-or just patching it? With 28 million Americans still uninsured and drug prices continuing to rise, these programs are essential. But they’re also a symptom of a broken system. Until drug pricing is regulated at the federal level, patients will keep relying on corporate goodwill to stay alive.

What You Should Do Now

If you’re struggling to pay for your prescription:- Check your drug’s manufacturer website. Look for “Patient Assistance” or “Copay Savings” tabs.

- Go to the Medicine Assistance Tool (MAT) and search by drug name.

- If you have insurance, ask your pharmacist if your plan uses copay accumulators. If yes, you may need to skip manufacturer cards.

- If you’re uninsured or underinsured, gather your income documents and apply for PAPs immediately.

- Don’t wait until you run out. Programs can take weeks to approve.

These programs aren’t perfect. But they’re real. And for millions of people, they’re the only thing standing between them and going without their medicine.

Can I use manufacturer assistance if I have Medicare?

Yes, but with major restrictions. You can use manufacturer copay cards to lower your out-of-pocket cost per prescription, but that money does NOT count toward your Medicare Part D out-of-pocket maximum (TrOOP). This means you’ll stay in the coverage gap longer. PAPs generally do not accept Medicare beneficiaries at all. Always check the specific program’s rules.

Do I need to reapply every year for Patient Assistance Programs?

It depends on the program. Some PAPs auto-renew as long as your income and medical need haven’t changed. Others require annual reapplication. Always check the renewal terms when you apply. Missing a deadline means your medication stops. Set calendar reminders and keep copies of all submitted documents.

Can I use copay cards with Medicaid?

Almost never. As of 2026, 78% of state Medicaid programs prohibit the use of manufacturer copay assistance. They believe it encourages higher drug spending. Even if you qualify for the card, your pharmacy will likely reject it. Don’t waste time applying-focus on PAPs or state-specific aid programs instead.

Are there income limits for copay assistance programs?

No. Copay assistance programs are usually available to anyone with private insurance, regardless of income. They’re designed to help with high deductibles and coinsurance. However, some programs require you to have insurance. If you’re uninsured, you’re not eligible for copay cards-you’ll need to apply for a PAP instead.

How do I know if a program is legitimate?

Stick to programs listed on the manufacturer’s official website or the Medicine Assistance Tool (MAT). Avoid third-party sites that ask for payment, credit card info, or personal details beyond what’s needed for eligibility. Legitimate programs are free to use and never charge you to apply.