The global generic drug market isn’t just about cheap pills anymore. It’s becoming the backbone of affordable healthcare for billions, even as it faces its toughest challenges yet. By 2030, more than half of all prescriptions worldwide will still be filled with generics-but the way they’re made, regulated, and sold is changing fast. If you think generics are simple copies of brand-name drugs, you’re seeing the past. The future is more complex, more competitive, and far more critical to global health.

Why generics still dominate, even as prices drop

Generic drugs make up 90% of prescriptions in the U.S., yet they account for only 23% of total drug spending. That’s the power of cost savings. A typical generic costs 80-85% less than its branded version. In India, a month’s supply of metformin for diabetes might cost $0.10. In Germany, it’s $1.50. In the U.S., it’s $4. Even with these differences, the math is clear: without generics, millions couldn’t afford treatment. But here’s the catch: margins are shrinking. Generic manufacturers saw average profit margins fall from 18% in 2020 to just 12% in 2024. Why? Too many companies chasing the same expired patents. When a blockbuster drug like Lipitor lost its patent, over 100 manufacturers jumped in. Prices collapsed. Today, some generics sell for pennies per pill. Companies that can’t scale or cut costs are getting squeezed out.The rise of biosimilars: the next big wave

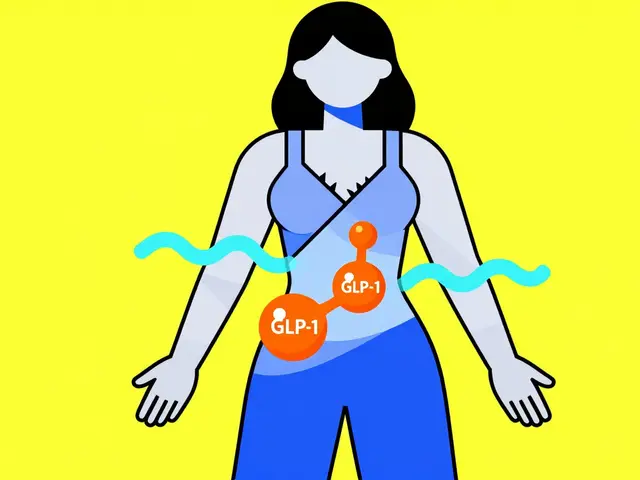

The biggest shift isn’t in small-molecule generics-it’s in biosimilars. These aren’t simple copies. They’re complex, large-molecule drugs that mimic biologics like Humira or Enbrel. Developing a biosimilar takes 10 to 20 times more steps than making a traditional generic. Costs? $100 million to $250 million, compared to $1 million to $5 million for a small-molecule generic. But the payoff is bigger. Biosimilars don’t slash prices by 80%. They offer 15-30% discounts. That’s still a huge win for insurers and governments. And demand is soaring. The global biosimilar market is growing at 12.3% annually through 2030. In Europe, biosimilars already make up 40% of the biologics market. In the U.S., they’re catching up fast. Drugs for rheumatoid arthritis, diabetes, and cancer are leading the charge. The problem? Only big players can afford it. Smaller generic companies lack the labs, regulatory expertise, and capital. That’s why we’re seeing more mergers. Companies like Teva, Sandoz, and Mylan are buying up biosimilar pipelines. If you’re not investing in biosimilars, you’re falling behind.Who’s driving growth? The pharmerging markets

North America and Western Europe aren’t growing much anymore. Their generic markets are mature. Prices are locked in. Regulations are strict. Growth here? Just 2-5% per year. The real action is in the pharmerging markets: India, China, Brazil, Turkey, Egypt, Saudi Arabia, and others. These countries are expanding healthcare access fast. India alone produces over 60,000 generic medicines and supplies 20% of the world’s generic volume by volume. China makes 40% of the world’s active pharmaceutical ingredients (APIs)-the raw building blocks of drugs. Governments are pushing hard. India’s Production Linked Incentive (PLI) scheme gave $1.34 billion to local manufacturers in 2024. China’s “Healthy China 2030” plan aims to cut drug import dependence by half. Saudi Arabia’s Vision 2030 includes building local generic production to reduce reliance on imports. These markets are growing at nearly 10% per year. By 2025, they’ll add $140 billion in new drug spending. That’s more than the entire generic market in the U.S. in 2023.

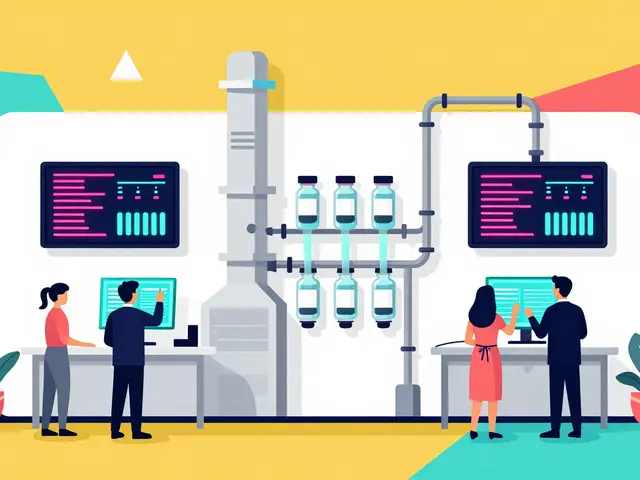

The supply chain problem: China’s chokehold

Here’s a scary fact: 65% of the world’s APIs for generics come from China. That’s not just a number-it’s a vulnerability. During the pandemic, when China locked down, generic drug shortages hit the U.S. and Europe hard. Insulin, antibiotics, heart medications-all slowed down. The FDA issued 187 warning letters to foreign manufacturers in 2023, and 40% of them were linked to quality control issues in China and India. Countries are waking up. The U.S. is trying to reshore API production with tax incentives. The EU is pushing for more local sourcing. India is investing heavily in API plants. But it’s slow. Building a single API facility takes 3-5 years and $200 million. For now, the world still depends on China. That’s a risk no one can ignore.Regulation: a patchwork that’s slowly coming together

There are 78 different drug approval systems around the world. That’s chaos for manufacturers. A drug approved in India might get rejected in the U.S. because of a different testing standard. That’s changing. The International Council for Harmonisation (ICH) is bringing more countries into alignment. In 2024 alone, 15 new countries adopted ICH guidelines. That means faster approvals, fewer delays, and lower costs. But quality control remains a nightmare. The FDA’s warning letters aren’t just paperwork-they’re red flags. One factory in Hyderabad was shut down in 2023 after inspectors found data falsification. Another in Shanghai had contaminated vials. These aren’t rare. They’re systemic. The solution? More transparency. More audits. More tech. Blockchain tracking of APIs is being tested in the EU. AI-powered quality checks are being piloted in the U.S. The goal: no more surprise recalls. No more “Made in China” stigma based on bad actors.

The future isn’t just cheaper-it’s smarter

The next generation of generic companies won’t just sell pills. They’ll sell services. Some are partnering with pharmacies to offer bundled care: a generic diabetes drug + monthly blood sugar monitoring + telehealth check-ins. Others are using AI to predict which patents will expire next and which markets will need them fastest. A few are even developing “follow-on” generics-slightly improved versions of old drugs that extend their life cycle without breaking patent rules. The winners will be those who think beyond manufacturing. Who see themselves as health partners, not just suppliers.What happens to branded drugs?

Don’t think generics are killing innovation. They’re forcing it. Branded drugmakers are shifting to specialty drugs-GLP-1 weight loss drugs, gene therapies, personalized cancer treatments. These cost tens of thousands of dollars a year. But they’re not for everyone. That’s where generics come in: they handle the chronic, everyday diseases-high blood pressure, asthma, depression, arthritis-that affect 41% of the global population. By 2030, generics will still make up 53% of prescriptions, even as their share of total drug spending drops from 57% to 53%. Why? Because specialty drugs are getting pricier. The pie is growing, but the slice for generics is shrinking slightly. That’s okay. Their job isn’t to dominate revenue-it’s to dominate access.Bottom line: accessibility over profits

The future of global generics isn’t about who makes the most money. It’s about who can deliver the most pills to the most people. The market is consolidating. The supply chain is fragile. The competition is fierce. But the need? It’s only growing. If you’re a patient in Nigeria, Brazil, or rural Indonesia, your life depends on these drugs. If you’re a policymaker in Germany or Canada, your budget depends on them. If you’re a manufacturer, your survival depends on adapting-whether that’s building biosimilars, securing API supply, or partnering with local clinics. The next five years won’t be easy. But if the world wants affordable healthcare, there’s no backup plan. Generics aren’t the future. They’re the present. And they’re here to stay.Are generic drugs as safe as brand-name drugs?

Yes, when they’re made by reputable manufacturers under strict regulations. Generic drugs must contain the same active ingredient, strength, dosage form, and route of administration as the brand-name version. They’re tested for bioequivalence-meaning they work the same way in the body. The FDA and other global regulators require the same quality standards. The main risk comes from unregulated or poorly inspected factories, which is why audits and supply chain transparency matter.

Why are biosimilars more expensive to make than regular generics?

Biosimilars are made from living cells-like proteins or antibodies-while traditional generics are chemically synthesized. Living cells are unpredictable. Every batch must be identical, which requires hundreds of precise steps, controlled environments, and advanced testing. A single change in temperature or pH can ruin the product. That’s why biosimilar development costs $100 million to $250 million, compared to $1 million to $5 million for a small-molecule generic.

Which countries are the biggest producers of generic drugs?

India and China are the top two. India produces over 60,000 generic medicines and supplies 20% of the world’s generic volume by volume. China manufactures about 40% of the world’s active pharmaceutical ingredients (APIs), which are the key components in drugs. Together, they account for roughly 35% of global generic manufacturing capacity. Other major players include Germany, the U.S., and Japan, but they focus more on high-value biosimilars and specialty generics.

Will generic drugs become obsolete with the rise of personalized medicine?

No. Personalized medicine-like gene therapies or targeted cancer drugs-is expensive and only works for small patient groups. Generics will still handle the bulk of chronic conditions: hypertension, diabetes, asthma, depression, and infections. These affect billions. Even if 10% of drugs become personalized, the other 90% will still need affordable, mass-produced options. Generics aren’t being replaced-they’re being redefined.

How are governments encouraging generic drug use?

Governments use several tools: mandatory substitution (pharmacists can swap brand for generic), price controls (like India’s National Pharmaceutical Pricing Authority), public procurement (buying in bulk), and reimbursement policies (insurers pay more for generics). In the U.S., Medicare Part D favors generics. In Germany, doctors must prescribe generics unless they write "not substitutable." In Egypt, 50% of essential medicines must be locally produced by 2025.

Erin Nemo

November 30, 2025 AT 06:48Generics are the unsung heroes of global health. I work in a clinic where patients choose between rent and meds - generics make that choice possible. No hype, no fluff, just life-saving pills at prices people can actually afford.

Bonnie Youn

December 1, 2025 AT 06:15YESSSS this is the real story nobody talks about 🙌 The drug companies want you to think generics are sketchy but they’re literally keeping millions alive. If you’re mad about prices dropping - good. That means competition is working. Stop crying and start supporting local manufacturing instead of blaming India 🇮🇳❤️

Lauryn Smith

December 2, 2025 AT 19:36I’ve seen firsthand how generics change lives. My mom’s blood pressure med used to cost $80 a month. Now it’s $4. She takes it every day. No more skipping doses. No more ER visits. That’s not just economics - that’s dignity. We need more of this, not less.

ariel nicholas

December 4, 2025 AT 16:50Rachel Stanton

December 6, 2025 AT 09:08Let’s talk biosimilars properly - this isn’t just ‘next-gen generics.’ It’s a whole new class of medicine. The complexity? Insane. The regulatory hurdles? Brutal. But the payoff? A diabetic in rural Kansas gets insulin for $25 instead of $300. That’s not innovation for profit - that’s innovation for humanity. We need more investment, not more fear.

Karandeep Singh

December 7, 2025 AT 04:12Suzanne Mollaneda Padin

December 8, 2025 AT 11:44As someone who’s worked with supply chains in Latin America, I can tell you - the real win isn’t just cheaper drugs. It’s when a clinic in Guatemala starts producing its own insulin vials using Indian APIs and local tech. That’s sovereignty. That’s resilience. We’re not just moving pills - we’re building systems.

Debbie Naquin

December 9, 2025 AT 03:29The paradigm shift isn’t in molecules - it’s in epistemology. The old model assumed equivalence = identity. But biosimilars force us to confront ontological uncertainty: if a protein folds differently in a Brazilian bioreactor than in a German one, is it still the same drug? Or is it a new entity shaped by context? The regulatory frameworks haven’t caught up - they’re still stuck in Cartesian reductionism.

Scotia Corley

December 10, 2025 AT 16:42It is a matter of grave concern that the integrity of pharmaceutical manufacturing has been compromised by profit-driven consolidation and regulatory arbitrage. The FDA’s 187 warning letters are not mere bureaucratic footnotes - they are a systemic indictment of global governance failure. One must ask: at what cost do we commodify human health?

Amber-Lynn Quinata

December 12, 2025 AT 00:32Some of us actually care about the people behind these drugs. I read about a factory in Hyderabad where workers were breathing in toxic dust for $2 a day so we could get $1 insulin. You call that ‘affordable healthcare’? Or is it just exploitation with a smiley face? 🤡

elizabeth muzichuk

December 13, 2025 AT 20:38And yet… no one talks about the mothers who cry because their child’s asthma inhaler got pulled again because ‘quality issues’ from China. This isn’t policy. This is a tragedy wrapped in a PowerPoint. I’ve been waiting for someone to say this out loud. The system is broken. And we’re all paying for it - with our kids’ lungs.

Alexander Williams

December 15, 2025 AT 10:20The biosimilar narrative is being weaponized by Big Pharma to extend monopolies under the guise of ‘innovation.’ If a company spends $200M to make a copy of Humira and sells it for 20% less, that’s not market disruption - that’s rent-seeking with a lab coat. The real innovation? Breaking patent evergreening. Not cloning biologics.

Kelly Essenpreis

December 17, 2025 AT 07:47Kenny Leow

December 17, 2025 AT 21:50Just spent time in a rural clinic in Ghana last month. They use Indian generics. No brand names. No drama. Just clear labels, reliable supply, and a nurse who remembers every patient’s name. That’s the future. Not fancy tech. Not lobbying. Just dignity in a pill bottle. 🙏